Starbucks Corp (NASDAQ:SBUX) Earnings Model

Author: Brian Zhou, Published: July 24, 2019 8:00pm Category: Earnings Preview (Prior to the F3Q2019 SBUX Results)

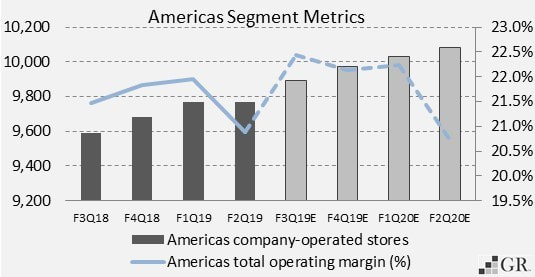

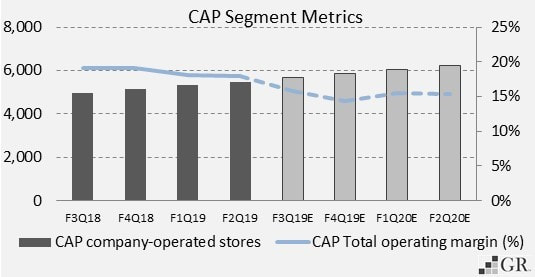

Starbucks delivered another strong performance in Q2 2019, with both top-line and bottom-line slightly beating analysts’ estimates. I believe that this momentum will continue to drive the company's operating result to the next level. Several solid factors contribute to justify this conclusion. First, I am confident that Starbucks' revolutionary product innovation, market-leading content digitalization as well as attractive customer loyalty program will consistently drive customer base retention and increase the customer re-visit rate. Second, strong U.S economic fundamentals lay a positive foundation for Starbucks to lift its total company-owned store counts, and raise product mix price for better probability. In China and the Asian-Pacific market, despite facing fierce competition, Starbucks is still considered the most prestigious beverage and coffee provider. By aggressively capturing extra market share, I anticipate the company's regional comp-store sales and regional total revenue will climb at the pace of 3% in 2019 and 2020. Finally, I expect the Federal Reserve will start to cut interest rates in July 2019, which will put downward pressure on the U.S dollar index. Therefore, I expect Starbucks' earnings would benefit about 20bps in 2019 and 30bps in 2020.

Based on these assumptions, I project Starbucks will generate approximate EPS of $0.60 (Non-GAAP: $0.68) for the third quarter of the fiscal year 2019. For the full fiscal year of 2019 and 2020, I anticipate Starbucks will deliver EPS of $2.32 (Non-GAAP: $2.70) and EPS of $2.48 (Non-GAAP: $2.83).

Based on these assumptions, I project Starbucks will generate approximate EPS of $0.60 (Non-GAAP: $0.68) for the third quarter of the fiscal year 2019. For the full fiscal year of 2019 and 2020, I anticipate Starbucks will deliver EPS of $2.32 (Non-GAAP: $2.70) and EPS of $2.48 (Non-GAAP: $2.83).

| SBUX Earnings Model (Brian Zhou).xlsx | |

| File Size: | 184 kb |

| File Type: | xlsx |

Disclosure: The author of this article/model has no financial investment or other conflict of interest related to the subject company or other companies discussed. Any views made or implied in the content represent the author’s opinions.