Starbucks Corp (NASDAQ:SBUX) Earnings Model

Author: Jake Zeidman, Published: July 17, 2019 6:50pm Category: Earnings Preview (Prior to the F3Q2019 SBUX Results)

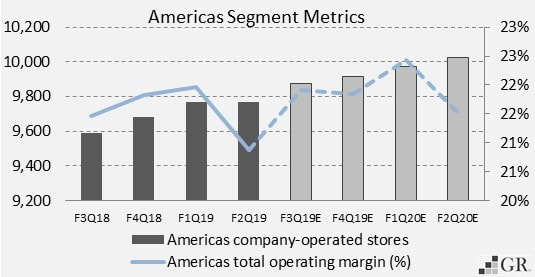

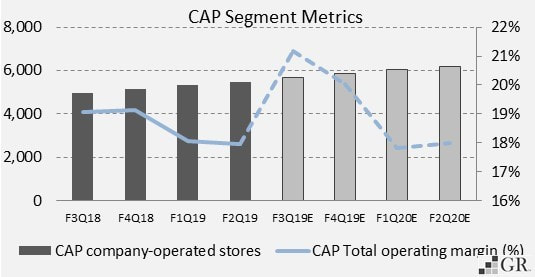

Model Description: The Starbucks Model reflects a bullish view on the company throughout the next few quarters. The model assumes that enhancements in store experiences, delivering beverage innovation, and the driving of digital relationships will lead to greater U.S store openings and greater revenue growth. In addition, it reflects that Luckin’s recent IPO will harm current Chinese growth but will not impact Starbucks as greatly as currently perceived overtime due to customer loyalty and an unsustainable strategy currently employed by Luckin Coffee. Finally, in Europe Starbucks will continue to license out the majority of its stores and continue to open newly licensed stores while closing company operated stores as part of its European Strategy. Overall, I believe that Starbucks will experience a 2019 full-year growth rate of 6.9%, at the top of managements 5%-7% targets and have continual growth in the future.

| |||||||

Disclosure: The author of this article/model has no financial investment or other conflict of interest related to the subject company or other companies discussed. Any views made or implied in the content represent the author’s opinions.