Starbucks Corp (NASDAQ:SBUX) Earnings Model

Author: Eduardo Carrasquilla, Published: October 27, 2020 10:08pm Category: Earnings Preview (Fiscal 4Q2020)

|

| ||||||||||||

American operated stores: Due to COVID Starbucks has been unable to give the full experience to their customers. This has been affecting Starbucks income, particularly in the Americas. I expect -15.2% decrease on income for the Americas operated stores. Driven by the following two factors:

- Net new company operated stores: Even though Starbucks expected to open 300 stores in the Americas to the 3 quarter the new operated stores got to 43 and based on the fears for a new lockdown due to COVID I expect the new operated companies to reach only 40 new company operated stores, which takes into consideration that some downtown store locations with no parking lots or drive throughs will close.

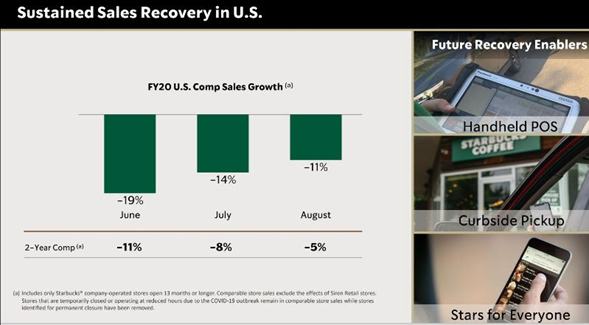

- Store Sales: I expect transactions to decrease by -30% which considers what happened with all the propaganda through the presidential campaign, but taking into account that the average ticket has increased around 27% for the 3q in 2020 my projections are that store sales will decrease by 20%.

International company operated stores: I expect the traffic to be lower, even though sales in August experienced a full recovery due to a higher ticket. Still considering that there is a fear that a new COVID wave is going to affect the goal of achieving 600 new stores for 2020. My projections are that in 2020 the new stores will reach 504, primarily in China.

I expect comp store sales to be similar to 2019, considering that in August the CFO showed full recovery on sales.

I expect comp store sales to be similar to 2019, considering that in August the CFO showed full recovery on sales.

Cost of Good sold: Coffee prices have been historically high this year, which has resulted in a greater operating expense compared to historic results. Still I expect this to be normal in 2021, and continue to be like this in 2022 and forward. For 4q 2020, I expected cost to be higher achieving operating expenses of 88% of revenue. This ratio will also likely be higher in 1q of 2021. This applies for international stores as well. This information is based on the Colombian coffee association, and their projections for 2020 and 2021.

Disclosure: The author of this article/model has no financial investment or other conflict of interest related to the subject company or other companies discussed. Any views made or implied in the content represent the author’s opinions.