Starbucks Corp (NASDAQ:SBUX) Earnings Model

Author: Ryan Burkart, Published: July 19, 2019 4:50pm Category: Earnings Preview (Prior to the F3Q2019 SBUX Results)

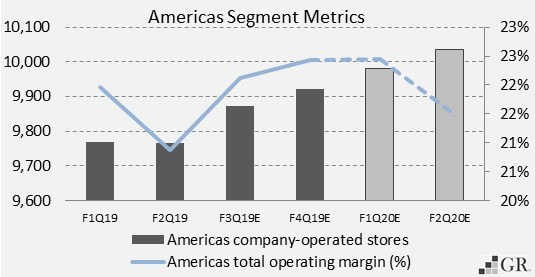

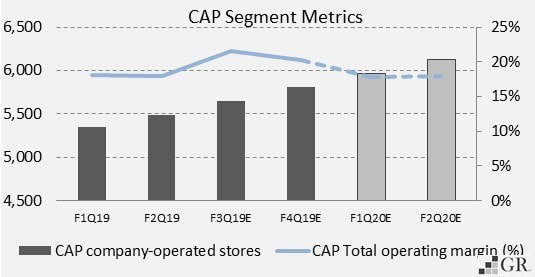

Model Summary: In projecting future financial estimates for the Starbucks corporation, the model shows that Starbucks will experience an improvement in revenue and operating margin from the Americas, with a slight reduction in the CAP and EMEA geographical segments in the later half fiscal year 2019 to early 2020. These conclusions were reached by considering the bullish gains in prior quarters in the U.S., the economic downturn in Europe, and the economic slowdown in Chinese economic growth as well as an increase in Chinese competitors. To create the model, I had to estimate the company and licenses store sales, the net number of new stores opened by the company for that fiscal year, and operating expenses that detract from the revenue earned.

Model Assumptions for the Americas and CAP Segments

| |||||||

Disclosure: The author of this article/model has no financial investment or other conflict of interest related to the subject company or other companies discussed. Any views made or implied in the content represent the author’s opinions.