Financial Modeling Cooperative Education Program (Virtual)

SKU:

$299.00

$299.00

Unavailable

per item

Summer 2023 Earnings Season Program (May 2023 Kick-Off)

Our financial modeling course offers an exciting real-world, real-time financial modeling experience. While participating in this program you will build a three-statement model for an actual public company (Starbucks Corp) before they report their next quarterly earnings results. Then, on the night of the filing, you will review the press release, check how close your forecast was, and update your model, in real-time, with the support of our instructor.

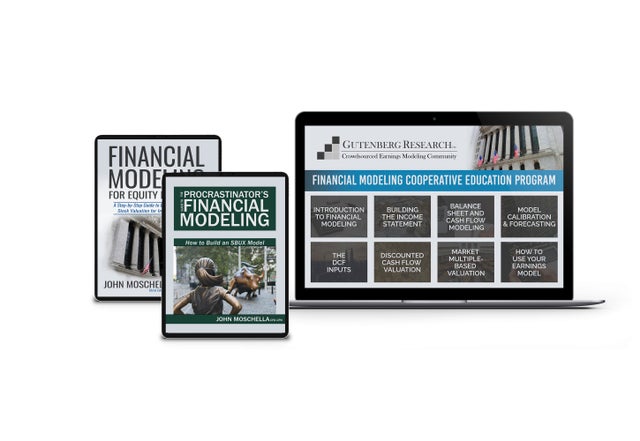

The Virtual Co-op Program includes the following items:

Our financial modeling course offers an exciting real-world, real-time financial modeling experience. While participating in this program you will build a three-statement model for an actual public company (Starbucks Corp) before they report their next quarterly earnings results. Then, on the night of the filing, you will review the press release, check how close your forecast was, and update your model, in real-time, with the support of our instructor.

The Virtual Co-op Program includes the following items:

- Digital copies of the textbooks.

- Access to the online Training Hub & pre-recorded class videos.

- Access to five virtual meetings.

- Access to the exam.

- Model review and feedback.

- Optional model publishing.

Closer Look at the Program...Notes From the Instructor

|

The clips below are excerpts from the live meetings of a past round of the program. These videos will give you an idea of how our classes are structured, and what our "real-world, real-time" format feels like on our calls. In addition, the program overview document (right) provides details of the summer schedule.

|

| ||||||

Example From Meeting #1: Building the Model

|

By the time we get to the first live meeting, you will have already watched the pre-recorded demonstration videos and read the first few chapters of the text. At this point most of the students are still getting comfortable with the material, so class participation tends to be low in the first meeting. This is perfectly fine. My goal is to keep the mood relaxed, so I will never cold-call anyone in class. That way you can remain comfortable and focused on the material. In fact, in the last few rounds, the vast majority of students chose to be silent participants on all of the calls, which is always fine with me.

|

|

Example From Meeting #2: Forecasting

|

In our second meeting we discuss how to develop and incorporate different opinions into the model to create a unique forecast. Most students enjoy this part of the process, and class participation tends to increase as students are beginning to get more confident in their modeling capabilities.

This clip captures the benefit of the "real-time" aspect of the program. The nature of this approach keeps the subject matter interesting, as we are all trying to figure out how to think about new information as it emerges. |

|

Example From Meeting #4: The Live Starbucks Earnings Release

|

Our fourth live meeting is the program’s main event. At this point we have built our models and entered our forecast. We will watch live as the subject company (Starbucks Corp) releases their quarterly earnings. As I discuss the results and update my version of the model, you will be able to follow along and check to see how close your forecast was.

|

|

Example From Meeting #5: Live FOMC Statement Release

|

As part of our DCF valuation exercise we forecast the primary components of the Equity Risk Premium (ERP) including interest rates and volatility. In Meeting 5, we discuss the Federal Reserve's FOMC statement as it is released, and compare our forecasts to the new data provided by the Fed. This clip is taken as the Fed announced their bond purchase taper in November of 2021.

|

|

As you proceed through the program you should find that it feels much more like on-the-job equity research training, and less like a textbook/classroom example. Overall, my students tend to find the experience to be enriching and fun. I hope you decide to join us in the next round, and if so, I am looking forward to working with you!