Facebook Inc Earnings Model (Neelaveni)

Author: Nilay Neelaveni, Published: July 19, 2020 11:12am, Category: Earnings Preview (Prior to the 2Q2019 earnings release)

Summary of Model: In creating this Facebook model, my first goal was to understand Facebook and its sector (Information & Technology). In these tumultuous times where the S&P 500 has fallen -2.44%, the Information & Technology sector has risen 18.04% YTD. I felt this could be explained by worldwide quarantining, forcing people all around the world to find safe haven in our social media outlets and computer games. I will be explaining in detail some of the biggest game changers in the Facebook model that help me take a bullish outlook for this coming earnings report on July 29, 2020.

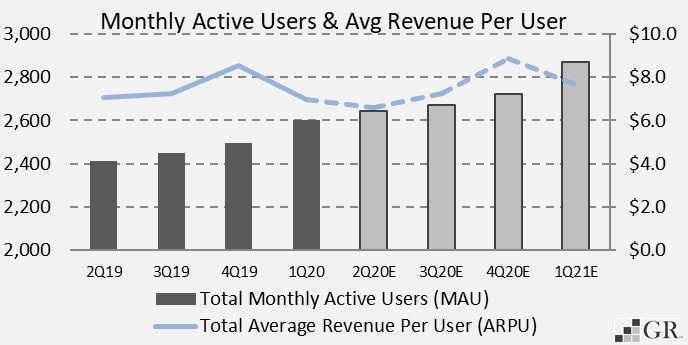

Monthly Active Users (MAU): This is an important way to see how successful Facebook has been in maintaining its consumer base. I have, in my model, MAU increasing this year for three reasons.

The first and most obvious is the quarantine that has kept so many at home. Even with the economy slowly opening, people are still afraid to leave their houses, and will be using programs like Facebook and even Oculus to keep themselves busy at home. Changes in Messenger and Facebook include bigger video call groups, which will further help people to quarantine at home with their friends.

The next reason is a rise of social movements. Facebook is one of the biggest platforms for this and I believe these social movements will continue for some time.

Lastly, as people test out the waters outside their homes, some of the first things they will be trying is outdoor nature activities like hiking or visiting the beach. Instagram and Facebook are the places where pictures will be posted and when folks return home cautiously from their activities, they will go back to viewing what their friends have been doing outdoor and isolated as well.

In the next year, the effects of COVID-19 will either have worn off or the public will now know how to live with it so I have the growth slowing as people will have work and other activities to do now.

Average Revenue Per User (ARPU): This is another important way to understand the success of Facebook regarding its source of revenue with ads. I believe there will be a gradual increase in ARPU after an initial decline. Though, there is a decline in pricing of the ads as well as a lower demand in ads, as conditions supposedly get better, ARPU will also increase. If COVID-19’s effect was not uncertain, I would increase the ARPU by much more. I am erring on the side of caution here. I am using this reasoning for all regions.

Monthly Active Users (MAU): This is an important way to see how successful Facebook has been in maintaining its consumer base. I have, in my model, MAU increasing this year for three reasons.

The first and most obvious is the quarantine that has kept so many at home. Even with the economy slowly opening, people are still afraid to leave their houses, and will be using programs like Facebook and even Oculus to keep themselves busy at home. Changes in Messenger and Facebook include bigger video call groups, which will further help people to quarantine at home with their friends.

The next reason is a rise of social movements. Facebook is one of the biggest platforms for this and I believe these social movements will continue for some time.

Lastly, as people test out the waters outside their homes, some of the first things they will be trying is outdoor nature activities like hiking or visiting the beach. Instagram and Facebook are the places where pictures will be posted and when folks return home cautiously from their activities, they will go back to viewing what their friends have been doing outdoor and isolated as well.

In the next year, the effects of COVID-19 will either have worn off or the public will now know how to live with it so I have the growth slowing as people will have work and other activities to do now.

Average Revenue Per User (ARPU): This is another important way to understand the success of Facebook regarding its source of revenue with ads. I believe there will be a gradual increase in ARPU after an initial decline. Though, there is a decline in pricing of the ads as well as a lower demand in ads, as conditions supposedly get better, ARPU will also increase. If COVID-19’s effect was not uncertain, I would increase the ARPU by much more. I am erring on the side of caution here. I am using this reasoning for all regions.

Facebook is a strong company with products in demand and strong management. It has a lot of cash and a strong balance sheet to weather this storm that most companies are facing and failing. This company is in a relatively strong position with my EPS prediction of 1.44.

| |||||||

Disclosure of Potential Conflicts of Interest: The author of this article/model has no financial investment or other conflict of interest related to the subject company or other companies discussed. Any views made or implied in the content represent the author’s opinions.